how are rsus taxed in india

Selling RSUs within 2 years of acquisition. RSU Withholding Rate A Common Confusion.

How Are Esops Rsus Taxed In India Aditi Bhardwaj Co

Am I getting double taxed in India for the RSUs that are listed on Nasdaq.

. Capital Gains Tax. RSUs are taxed at the ordinary income rate when issued typically after a vesting schedule. The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part.

The ordinary earned income tax rate when the RSUs vest or. The nature of the gains will determine the amount of tax the employee will have to pay. Such a perquisite is taxable as part of salaries under section 172 of the Income-tax Act and TDS is adequately deducted by the employer based on slab rates.

Answer 1 of 3. And if taxed can someone write down details about it. The ESPPs or RSUs received by you as part of your salary is taxable as perquisites under income from salary.

On exercise of the ESOPs RSUs. So you have to pay tax on all Rs 1 lac however if its RSU of a public listed Indian company your tax will be NIL because of long term capital gains but if its a out side india listed company then 20 of 1 lac which is Rs 20000. When it thereafter vests you would generally be responsible for the taxes in that original location.

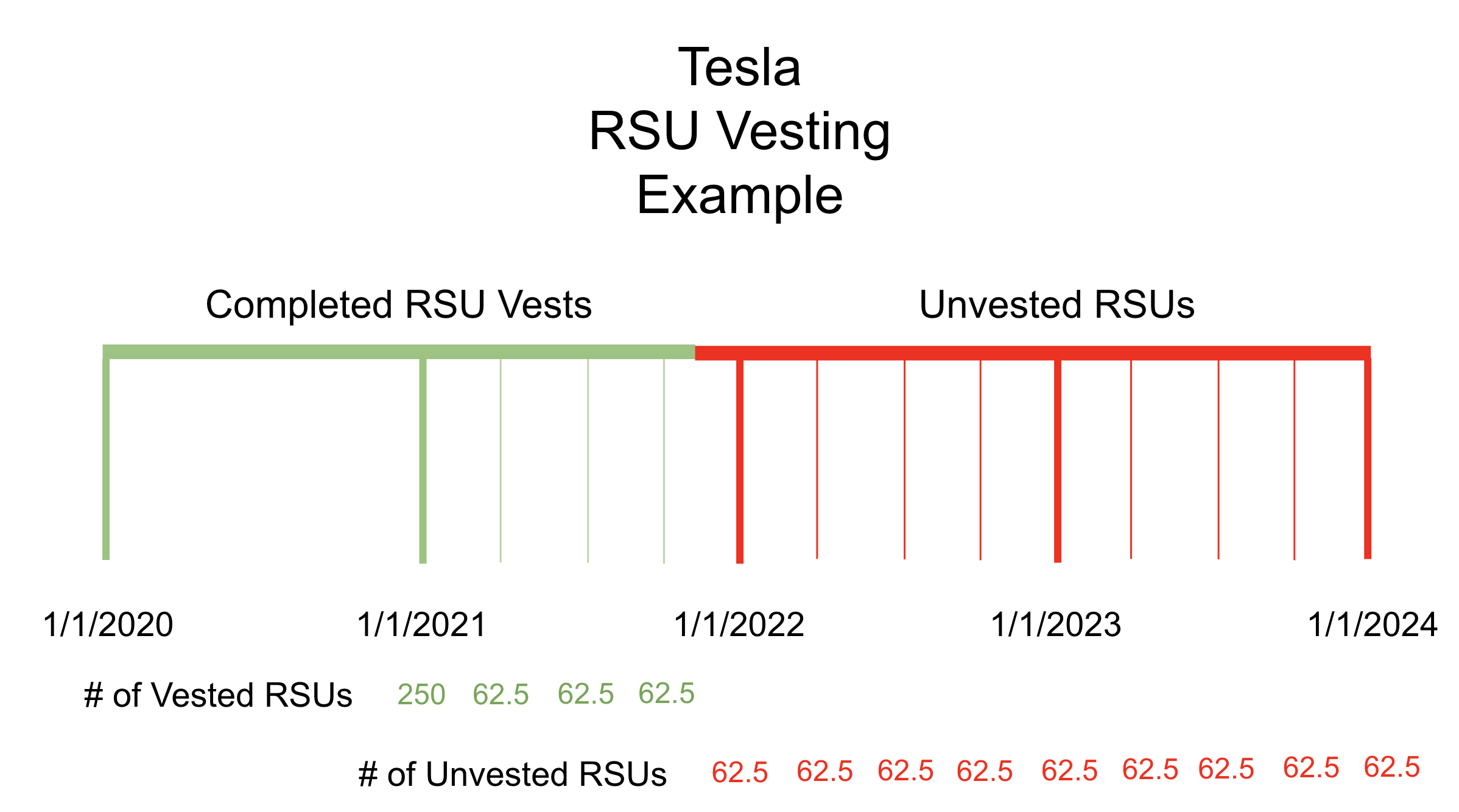

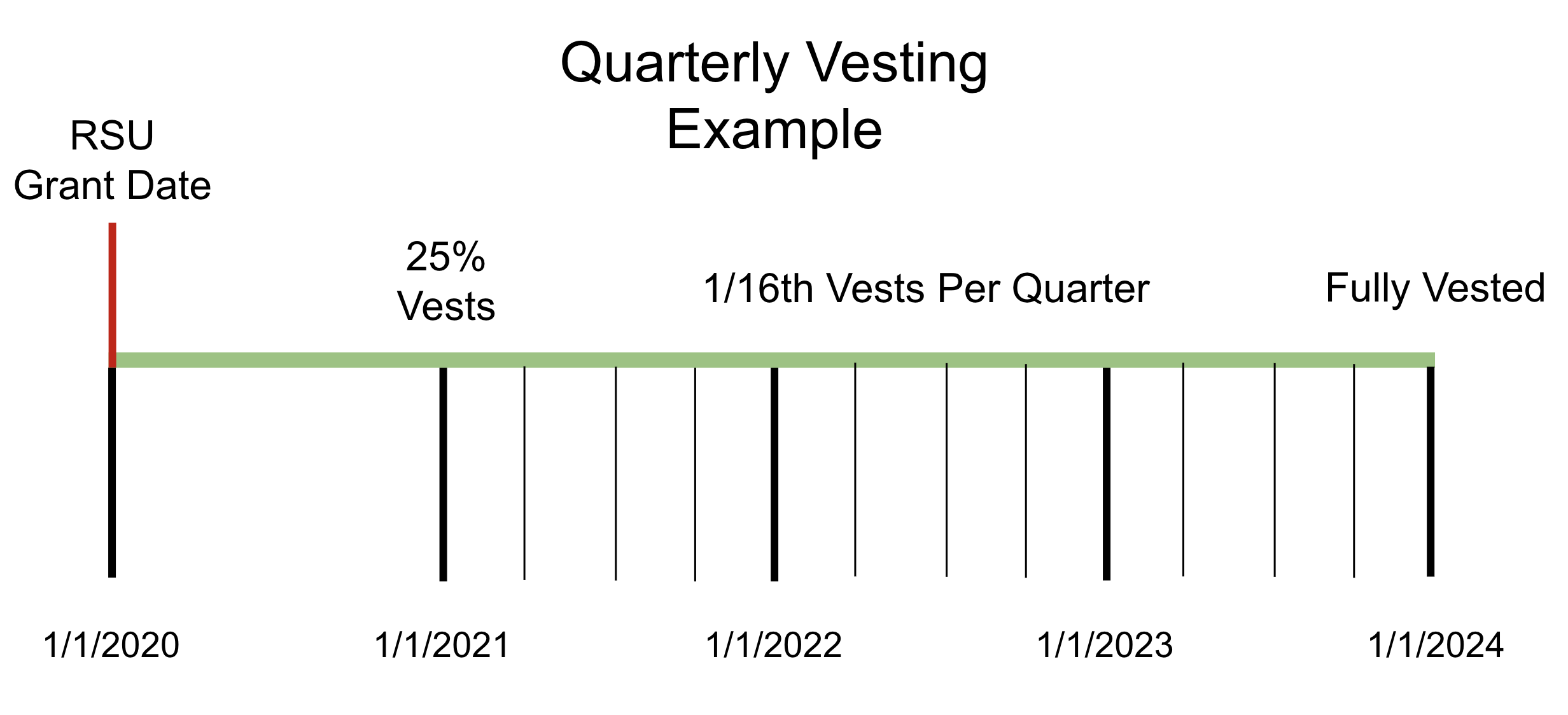

Employees pay taxes each time their RSUs vest - so four times a year. The RSU which were allotted to you in India are the non-monetary benefits received in course of your employment and are hence considered has perquisites and a tax at source is deducted in India TDS on the market value of the RSU on the date they become vested in your hands say for eg the market price on that day in Indian rupees as 100 so the TDS 30 assuming that your. Yes flat 20 when you get it and 10 when you sell it.

Todays new employees receive 5 percent of their RSUs every three months for five years. You will need proof of the payment of foreign tax. Compared to other forms of equity compensation the tax treatment of RSUs is pretty straightforward.

This is true whether were talking about. This is the tax effect at the time of acquiring ownership ie. The loss from the sale of shares can be carried forward up to 5 years.

Microsoft rewards RSUs in August. The restricted stock units RSU are assigned a fair market value when they vest. RSUs are taxed as income to you when they vest.

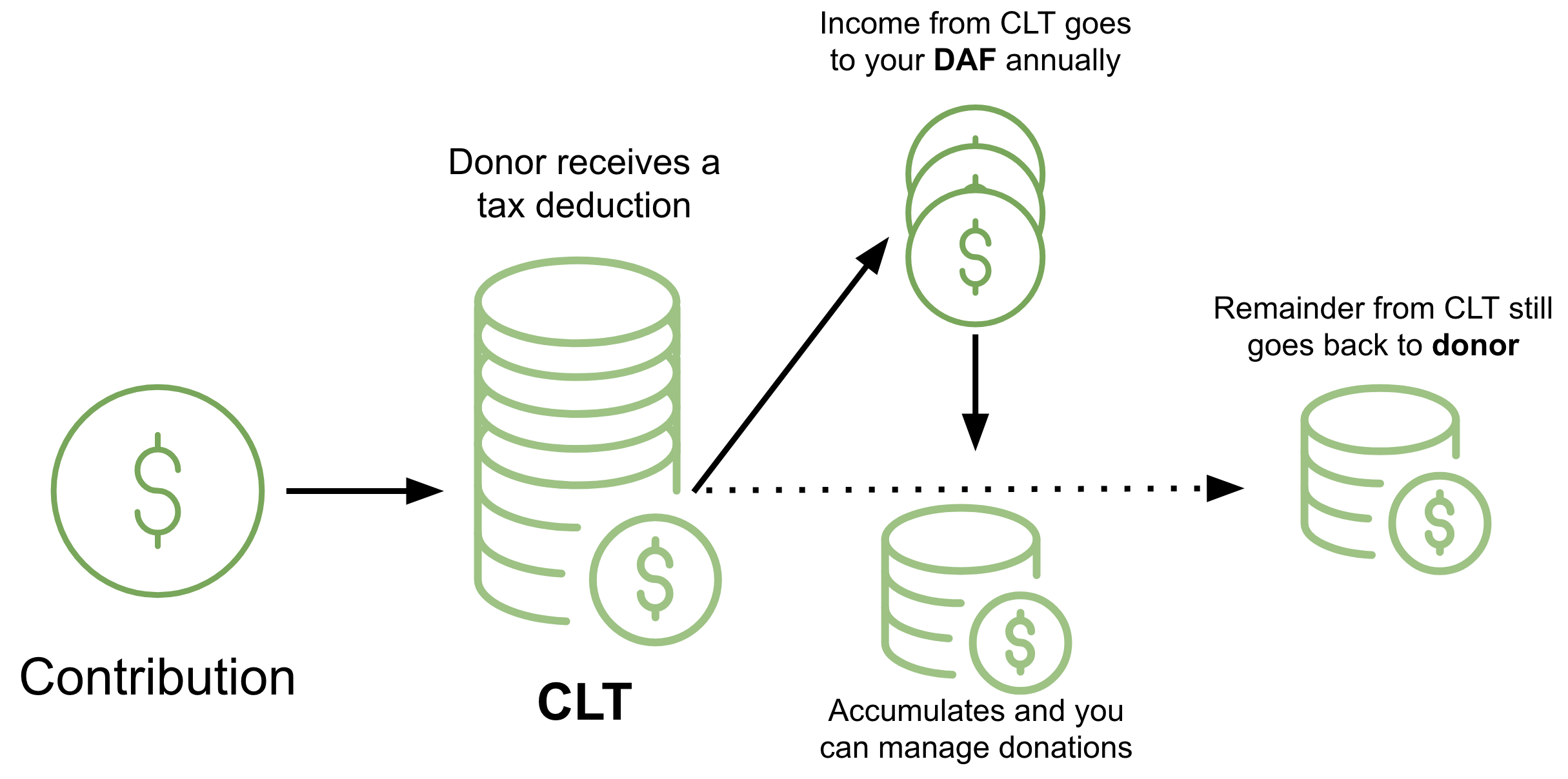

However if there double taxation you can get the credit of foreign tax deducted while filing our income tax return. Older employees receive 10 percent of their RSUs every six months for five years. The income for RSU is usually taxed in the jurisdiction of residence at the time it was granted.

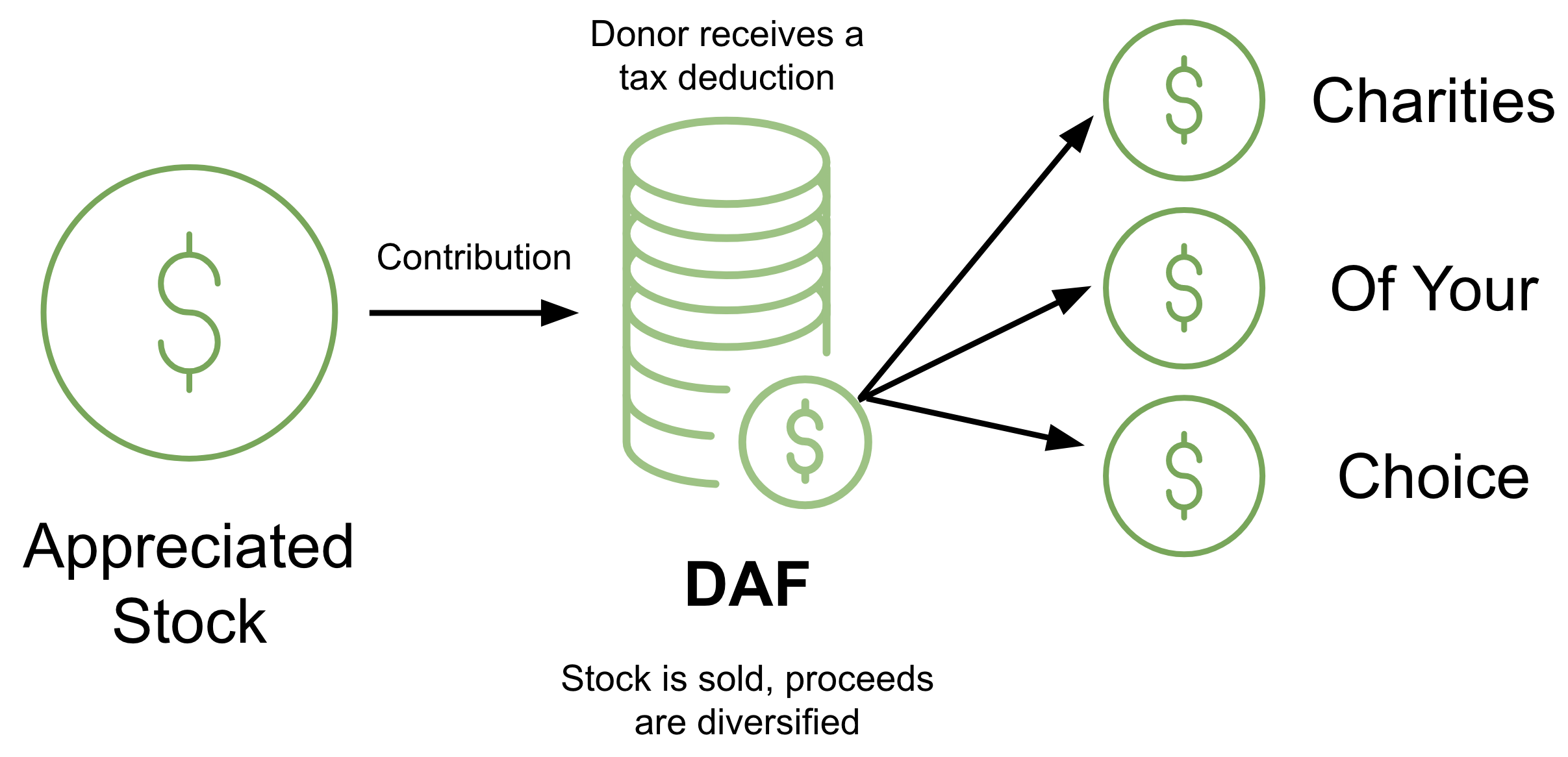

If you sell your shares immediately there is no capital gain tax and the only tax you owe is on the income. When an employee sells their ESPP ESOP or RSU once the vesting period is complete and receive their money it is their duty to pay tax on that amount in India. Sale value added to income tax amount and taxed as per applicable slab.

Theres some backend currency conversion going on but we wont bore you with that in this article - your Company will take care of this you dont need to worry about it. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock. However you will likely also meet US tax residency rules which means you would be reporting it on the US side as well and then taking the foreign tax credit.

Such a perquisite is. Its important to remember that the RSU tax rate will be the same as your income tax rates. Pay income tax after adding such shares to taxable income.

Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. I see that the foreign brokerage firm sells 30pct of the grant in USD when vested and tax again gets deducted in INR for the grants. Generally there is no double taxation since US MNCs with employees in India generally submit W-8BEN to US brokers to avoid any withholding related to US taxes.

Taxability on acquiring ownership. However its still important to understand and manage it appropriately. RSU Tax Rate vs.

So RSUs are taxed twice. The capital gains tax rate when you sell the shares you own. RSUs are taxable in two instances in India.

In India or in US is RSU taxed. RSUs are only exposed to capital gains tax if the stockholder holds onto the stock and it. Ordinarily owners of restricted stock arent taxed on the receipt of their shares until their vesting day.

Ordinary Income Tax. If desired however those with restricted stock may elect to use Section 83b which allows them to pay tax on the fair market value of their shares on their grant date rather than when they become vested. About 6522 value is consumed in tax.

Since the ownership of these valuable shares comes free of cost or at a nominal price it is a considered as an employment perk or a perquisite in taxation terminology. This will show up in your Form 16. Upon vesting they are considered income and a portion of the shares are withheld to pay income taxes.

Indian company also has calculated perquisite based on FMV on total number of stocks including withheld stocks and properly deducted TDS 309 and remitted the TDS and issued Form 16 for FY2018-19 and it is properly reflecting in Form 16 Part A and Part B. Selling RSUs later than 2. When shares are allotted to the employee after he has exercised the option on completion of the vesting period When the employee opts to sell the allotted shares under the RSU.

Understanding Your Tax Impacts as a Microsoft Employee. The employee receives the remaining shares and can sell them at any time.

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Stock Options Vs Rsus What S The Difference Thestreet

How To Avoid Taxes On Rsus Equity Ftw

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Of Mnc Perquisite Tax Capital Gains Itr

How To Avoid Taxes On Rsus Equity Ftw

Income Tax Implications On Rsus Or Espps

What Happens To Rsus When You Quit Equity Ftw

Tax Planning For Stock Options

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Understanding Rsu Esops Espp Tax Implications Mymoneysage Blog

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

A Guide To Restricted Stock Units Rsus And Divorce

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana